Central Banks Must Remain Vigilant Along The Last Mile Of Disinflation – Analysis

A sense of optimism has pervaded financial markets in recent months, amid investor confidence that the fight against inflation is entering its “last mile” and that central banks will ease monetary policy in the coming months. Stock markets around the world have risen substantially this year. Corporate and sovereign borrowing spreads have narrowed. And major emerging markets’ currencies and capital flows have remained resilient, while several frontier markets have regained access to international funding markets.

And yet, there are likely to be bumps along this last mile, as we show in the latest Global Financial Stability Report. Geopolitical tensions could intensify and weigh on investor sentiments. Strains in commercial real estate have become more acute, which could increase pressure on some lenders. China’s financial markets continued to be weighed down by ongoing problems in the property sector. Beyond these more immediate concerns, debt vulnerabilities continue to grow, with both the public and private sectors in many countries borrowing heavily, even though interest rates are still high and economic growth will likely not accelerate, as projected by the World Economic Outlook.

Taking a step back, there is recent evidence that disinflation may have stalled in some countries, and that underlying inflation may be persistent in some sectors. In some cases, core inflation has come in higher than analyst forecasts for consecutive months. Higher-than-expected readings could challenge the last-mile narrative and the related investor optimism, potentially leading to financial market repricing and higher volatility.

Sticky inflation

After decelerating quickly worldwide, inflation has diverged more recently across countries. Data so far this year show that core inflation accelerated in the most recent three months versus the three months prior in a number of major advanced and emerging economies (Czech Republic, France, Germany, Italy, Philippines, South Africa, Sweden, United Kingdom, United States).

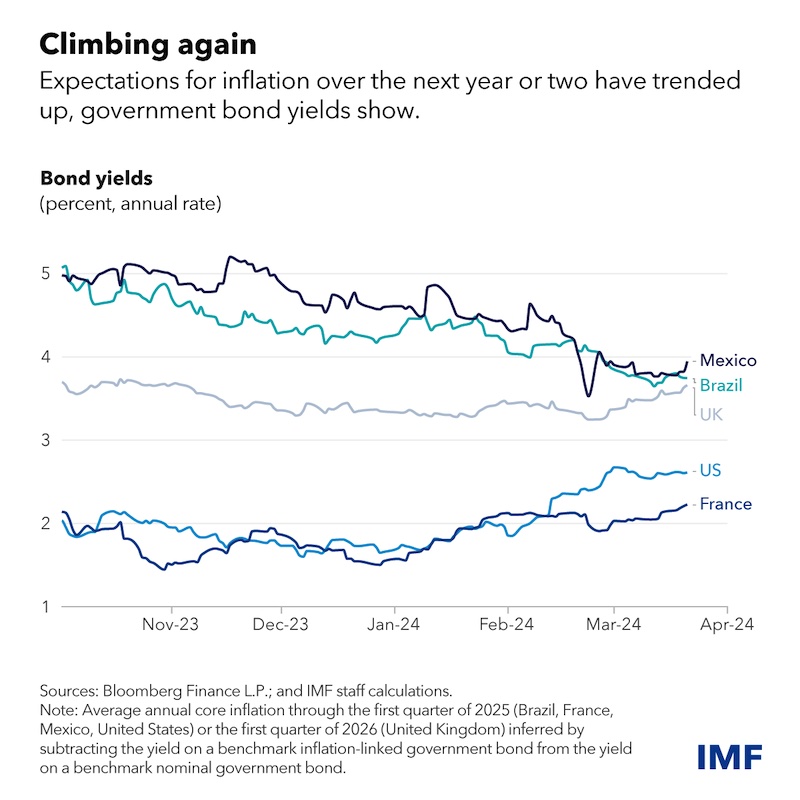

Looking ahead, some investors appear to anticipate price pressures may not subside rapidly. Expectations for inflation in major economies over the next year or two—implied by the difference between nominal and inflation-linked government bond yields—have been climbing again. Importantly, they remain above central bank target levels of 2 percent, as in France, the United Kingdom and the United States, or 3 percent, as in Brazil and Mexico. Other measures of inflation expectations, like those from household surveys, appear more stable.

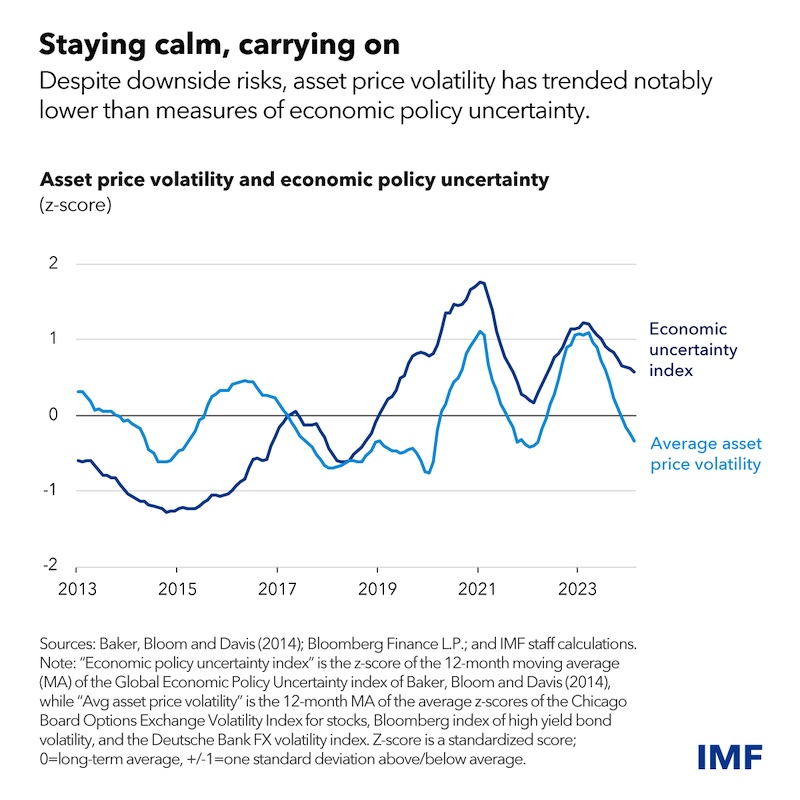

At the same time, an intensification of geopolitical tensions could further disrupt shipping and energy production and push up inflation once again. So far, financial markets have remained broadly sanguine about stalling disinflation and other headwinds and risks, with volatility in major asset classes currently at low levels despite elevated measures of economic policy uncertainty.

Repricing risks

Traditionally, a divergence between asset price volatility and uncertainty has preceded volatility spikes, which could occur when investors are jolted by adverse shocks, prompting their re-valuing of assets to account for high uncertainty.

One such adverse shock along the last mile could be upside inflation surprises. Despite the aforementioned uptick in projected future inflation in various countries, investors anticipate substantive policy rate cuts this year—reduction of about 75 basis points by the European Central Bank and the Central Bank of Brazil. Despite a string of upside inflation surprises in the United States, the Federal Reserve is still expected to cut rates by about 50 basis points. Investors appear to trust that data-dependent central banks will ease monetary policy when inflation decelerates further. But if inflation remains high, such lofty expectations could topple, which could lead to a correlated selloff of assets, from bonds to stocks to crypto assets.

Under this scenario, financial conditions would broadly tighten. Most immediately, some investors would face losses on the assets they hold, especially leveraged investors whose negative returns would be magnified. Globally, borrowers would find it harder to service debt, given higher bond yields.

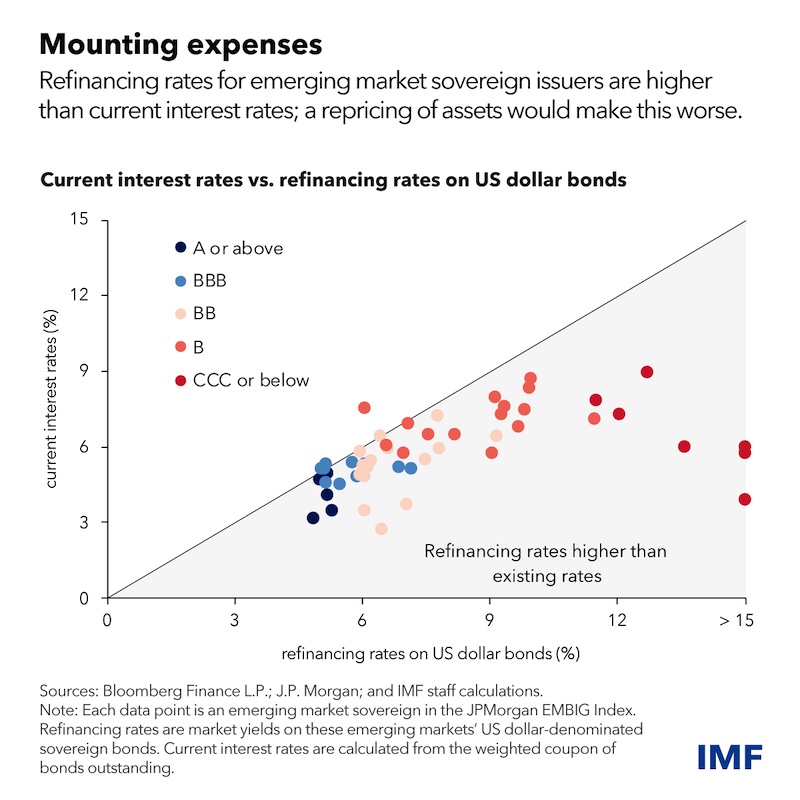

Emerging market borrowers are often disproportionately affected in these situations. Many such issuers already face refinancing rates higher than interest rates on outstanding US dollar-denominated sovereign bonds. More vulnerable emerging markets—those with credit ratings of B and CCC or below—face the largest increase in rates. An inflation-driven tightening of global financial conditions would make refinancing even more difficult.

Commitment to disinflation

The stalling of disinflation may surprise investors who are increasingly convinced that the battle against inflation has already been won and that low rates will prevail again. In economies still experiencing persistent and above-target inflation, central banks should not prematurely ease to avoid having to backpedal later. They should also push back against overly optimistic investor expectations for monetary policy easing, which has led to some exuberance in financial markets. Of course, where progress on inflation suggests it is moving sustainably toward target, central banks should gradually move to a less restrictive stance of policy.

Preserving financial stability along the last mile requires a multi-pronged approach. Financial regulatory authorities should take steps to ensure banks and other institutions can withstand defaults and other risks, using stress tests, early corrective actions, and other supervisory tools. Regulators should prioritize full and consistent implementation of internationally agreed prudential standards, notably finalizing the phase-in of Basel III. Further progress on recovery and resolution frameworks is also of first order importance, to limit the fallout from the demise of weaker institutions. Central banks should ensure banks have access to liquidity facilities when needed and be prepared to intervene early to address funding stress in the financial sector.

—This article is based on Chapter 1 of the April 2024 Global Financial Stability Report. For more, listen to the podcast with Deputy Director Fabio Natalucci and Assistant Director Jason Wu of the IMF’s Monetary and Capital Markets Department.

- About the author: Tobias Adrian is the Financial Counsellor and Director of the IMF’s Monetary and Capital Markets Department. He leads the IMF’s work on financial sector surveillance and capacity building, monetary and macroprudential policies, financial regulation, debt management, and capital markets. Prior to joining the IMF, he was a Senior Vice President of the Federal Reserve Bank of New York, and the Associate Director of the Research and Statistics Group.

- Source: This article was published by IMF Blog